Jacksonville Estate Lawyer

When writing your estate plan, it will help to have a list of your assets and who you want to receive these assets after you pass away. Many people find peace of mind once they develop an estate plan, because they know that their legacy will be protected and handled in the way they prefer after their departure. Our Jacksonville, FL estate lawyer can guide you through the steps of creating an estate plan if you are not sure where to begin. At Sahyers Firm LLC, we have helped so many families establish legally-binding documents that protect what they have built over a lifetime. We’re committed to protecting what matters most to you. If you have questions about anything estate plan-related, don’t hesitate to contact us today for help.

Beneficiary Designations

A beneficiary designation involves naming the people who will receive your assets after your death. Who you choose as beneficiaries should be those who value you and care about your legacy. The most commonly chosen beneficiaries are spouses, children, siblings, or close friends you consider family. You can also choose a charity organization as a beneficiary to your estate as well. Choosing beneficiaries is an important task when creating an estate plan because these are people who will carry on what you have built over your lifetime.

Considering Family Dynamics

Our knowledgeable estate attorney understands that you may be thinking about your family dynamics. The relationships between your family members or beneficiaries may not all be positive. You may realize that there are some friendships that mean more to you than blood relatives. Your decisions about who you choose as beneficiaries is completely up to you and your personal preference.

Who you designated and which assets are going to be distributed to them can have an impact on your family dynamics after you have passed on. While this shouldn’t be the primary motivation for who you choose, it is an aspect of this task to keep in mind. No matter how you divide up your estate, having our team review it so that we can ensure everything is in legal order and reflects your best interest.

Achieving Peace Of Mind

Having an estate plan can bring you and your family peace of mind knowing that the future will be handled in the way you most prefer. You will have legally-binding documentation that instructs to whom and which assets you want distributed. There are several types of documents that you can use for your estate plan, whether that be a living will, trust, will, durable power of attorney, health care surrogate, advance directive, pet trust, and pour-over will, among others.

Reach Out To Sahyers Firm LLC

Once we learn more about your needs we can recommend which will best serve you and safeguard your assets until it is time for them to be distributed to your chosen beneficiaries. As our Jacksonville estate attorney explains, without having your wishes written, your legacy is at risk of being dealt with in a manner you would not have wanted. If you have questions or are ready to get started today, all you have to do is contact our team at Sahyers Firm LLC to begin!

Determining Who You Want As Your Executor Of Your Estate Plan

Our Jacksonville, FL estate lawyer knows that choosing the right person to serve as the executor of your estate is a significant decision when creating an estate plan. The executor is responsible for carrying out the terms of your will, managing assets, paying debts, and ensuring your beneficiaries receive their inheritances. This role comes with important responsibilities, and it’s critical to select someone you trust to handle these tasks effectively. It is crucial to work with a lawyer who knows the ins and outs of wills, probate, and estate planning, so call now. I founded my firm with the hope of providing my clients with dedication and excellent services, so see what I can do now.

Key Qualities To Consider

The first step in deciding who should serve as your executor is identifying the qualities that make someone well-suited for this role. Trustworthiness is essential. You need someone who will honor your wishes and act in the best interests of your beneficiaries. Strong organizational skills are also important, as the executor will manage multiple tasks, from dealing with legal documents to distributing assets.

It’s also helpful to choose someone who has a basic understanding of finances and can make sound decisions under pressure. While the executor doesn’t need to be an accountant or financial professional, they should be comfortable working with numbers and handling financial responsibilities.

Evaluating Potential Candidates

Many people choose a close family member, such as a spouse, adult child, or sibling, to serve as their executor. While this can be a good option, it’s important to think carefully about whether the person you’re considering is well-equipped to handle the role. Consider their relationship with other beneficiaries and whether they can approach the responsibilities impartially.

If you’re concerned that family dynamics could complicate matters, you might consider naming a trusted friend or even a professional executor, such as a financial institution or attorney. A professional can offer objectivity and experience, which can be especially valuable in complex or contested estates.

Practical Considerations

Our Jacksonville estate lawyer knows that when selecting your executor, it’s important to consider practical factors such as their age, health, and location. An executor needs to be available to handle estate matters, which can take months or even years to resolve. Someone who lives far away or has significant personal obligations may find it challenging to manage the demands of the role.

You should also name an alternate executor in case your first choice is unable or unwilling to serve when the time comes. This ensures your estate is handled without delays if unforeseen circumstances arise.

Communicating Your Decision

Once you’ve decided who you want as your executor, it’s essential to communicate your decision with that person. Discuss the responsibilities involved and confirm they’re willing to take on the role. Providing them with an overview of your estate plan can also help them feel prepared to carry out your wishes.

Let Us Help You With Your Estate Planning

Choosing the right executor is an important part of your estate plan, and we’re here to guide you through the process. Knowing that the estate administration process goes smoothly can give you peace of mind. At Sahyers Firm LLC, we work with you to create a comprehensive plan that reflects your wishes and protects your loved ones. Contact our Jacksonville estate lawyer today for a consultation to get started and ensure your estate is in good hands.

5 Common Mistakes An Estate Attorney Can Help You Avoid

Planning for the future requires careful consideration, especially when it comes to protecting your assets and confirming that your loved ones are taken care of. Unfortunately, many individuals make pivotal mistakes when handling their estate plans. Our estate lawyer in Jacksonville, Florida, can help you avoid these pitfalls, providing guidance tailored to your specific needs. Below are five common estate planning mistakes and how our professionals at Sahyers Firm LLC may help you steer clear of them.

-

Failing To Create A Will Or Estate Plan

One of the biggest mistakes people make is assuming they do not need a will or estate plan. Without a legally binding document outlining your wishes, the state decides how your assets will be distributed. This can lead to unintended consequences, lengthy court battles, and unnecessary stress for your loved ones. An estate attorney will draft a legally sound will that reflects your intentions, making certain that your family is protected.

-

Not Updating Your Estate Plan Regularly

Life is constantly changing—marriages, divorces, births, and financial shifts can impact your estate plan. However, many people fail to update their documents, which can result in outdated beneficiaries, unintended asset distributions, or even legal challenges. An experienced attorney will review your estate plan periodically to confirm that it aligns with your current circumstances and goals.

-

Overlooking Beneficiary Designations

Many individuals assume that their will dictates all asset distributions, but retirement accounts, life insurance policies, and certain bank accounts pass directly to named beneficiaries. If you forget to update these designations, an ex-spouse or unintended recipient may inherit significant assets. Our Jacksonville estate lawyer trusts may review and update your beneficiary designations to verify that your wishes are honored.

-

Ignoring Tax Implications

Estate taxes and inheritance laws can significantly impact how much of your wealth is passed down to your heirs. Without proper planning, your loved ones may face hefty tax burdens, reducing the assets they receive. A knowledgeable estate attorney can structure your estate to minimize taxes, utilizing tools like trusts and gifting strategies to maximize wealth preservation.

-

Choosing The Wrong Executor Or Trustee

Selecting an executor or trustee is a important decision, yet many people choose someone without considering their financial acumen, trustworthiness, or ability to handle responsibilities. A poorly chosen executor can lead to delays, conflicts, and even legal issues. Consulting with a legal professional makes certain that you appoint someone capable of effectively managing your estate.

How An Estate Attorney Safeguards Your Future

Estate planning is a difficult process, but avoiding these common mistakes can save your loved ones from unnecessary stress and complications. By working with our skilled estate lawyers, you can verify that your assets are protected, your wishes are honored, and your family is financially secure. If you need help with estate planning, contact us at Sahyers Firm LLC today for professional guidance tailored to your needs.

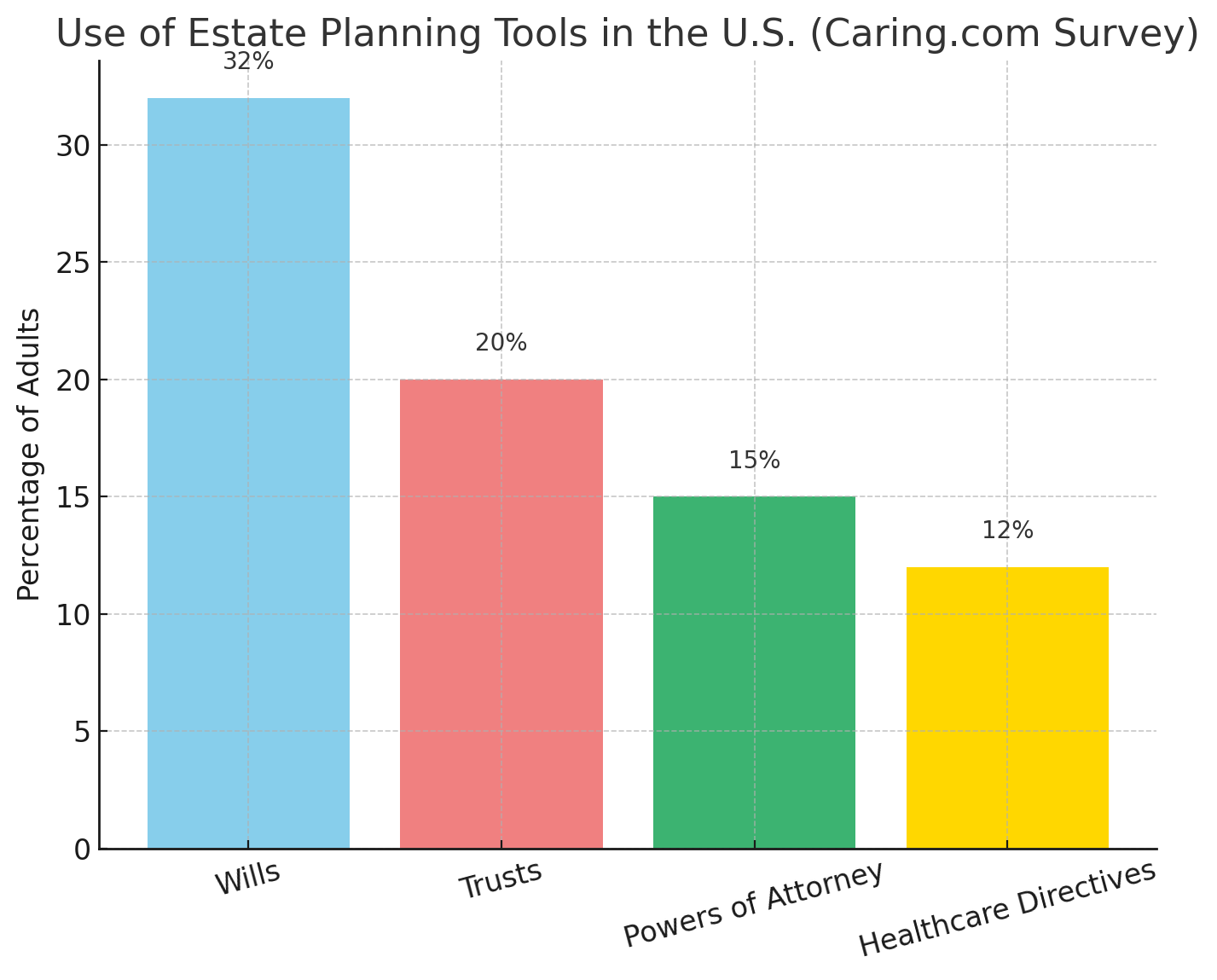

Jacksonville Estate Planning Statistics

Estate planning tools, such as wills, trusts, powers of attorney, and healthcare directives, are essential for managing assets, protecting loved ones, and ensuring that an individual’s wishes are honored. Despite their importance, a significant portion of Americans do not utilize these tools. According to a survey by Caring.com, only about 32% of U.S. adults have a valid will or trust, while even fewer have comprehensive estate planning documents such as powers of attorney or healthcare directives.

Wills are the most commonly used estate planning tool, allowing individuals to designate how their assets will be distributed after death. Trusts, particularly revocable living trusts, are increasingly used to avoid probate, manage assets during life, and provide for minor children or beneficiaries with special needs. Powers of attorney are critical for financial decision-making if an individual becomes incapacitated, while healthcare directives guide medical care in situations where the person cannot communicate their wishes.

Estate Planning FAQs

Planning for the future is one of the most meaningful steps you can take to protect your family and your assets. Whether you’re drafting your first will, setting up a trust, or reviewing an existing estate plan, having the right guidance makes all the difference. Our Jacksonville estate lawyer can help you understand your options, ensure your documents comply with Florida law, and give you confidence that your wishes will be honored. Below, we’ve answered some of the most common questions we hear about estate planning.

What Does An Estate Planning Attorney Do?

An estate planning attorney helps individuals draft and finalize legal documents that dictate how their assets will be managed and distributed. This includes creating wills, establishing trusts, minimizing estate taxes, and appointing powers of attorney. Our Jacksonville, FL estate lawyer may also help clients plan for incapacity by preparing healthcare directives and financial power of attorney documents, making certain that trusted individuals can make decisions if the client becomes unable to do so.

Do I Need A Will Or A Trust In Florida?

Having a will or a trust is imperative for making sure that your assets are distributed according to your wishes. A will is a legal document that designates beneficiaries and appoints guardians for minor children, but it must go through probate, which can be a lengthy and costly process.

A trust, on the other hand, allows assets to bypass probate and transfer directly to beneficiaries. Trusts also offer more control over how and when assets are distributed. For example, a trust can specify that beneficiaries receive their inheritance at certain ages or under specific conditions.

How Can I Avoid Probate In Jacksonville?

Probate can be avoided through strategic estate planning. Probate is the legal process of distributing assets under court supervision, and it can take months or even years to finalize. Establishing a revocable living trust allows assets to transfer directly to beneficiaries without court involvement. Additionally, naming beneficiaries on financial accounts such as life insurance policies and retirement funds verifies that those assets pass directly to the intended recipient. Another way to avoid probate is through joint ownership of property with a right of survivorship, which allows the surviving owner to inherit the property automatically.

What Happens If I Die Without A Will In Florida?

If you die without a will in Florida, your assets will be distributed based on the state’s intestacy laws. Typically, this means assets go to a spouse, children, or closest relatives in a predetermined order. Without a will, you have no control over who inherits your estate, and the process can take longer due to legal requirements.

When Should I Update My Estate Plan?

You should update your estate plan whenever a major life event occurs. Changes such as marriage, divorce, the birth of a child, or a significant financial shift may require modifications to your will or trust. Moving to a new state is another important reason to review your estate plan, as different states have varying legal requirements. Even if no major changes occur, it is a good idea to review your plan every few years with a Jacksonville estate lawyer to confirm that it aligns with your current goals and remains compliant with Florida laws.

Estate planning doesn’t have to be overwhelming—with professional guidance, you can create a plan that provides clarity and peace of mind for you and your loved ones. Whether you need to establish a will, create a trust, or update an existing plan, our Jacksonville estate law attorney is here to help. Contact our firm today to schedule a consultation and start building a plan that protects your future.

Estate Law Glossary

Creating a comprehensive estate plan means understanding key terms that directly impact your decisions. Our Jacksonville, FL estate lawyer provides personalized legal support designed to help you make informed choices that reflect your wishes and protect your assets. This glossary breaks down five important estate planning terms you may encounter when preparing your plan.

Executor Of Will

An executor of a will is the person named in your will to carry out your final instructions. This individual is responsible for managing your estate after your death, which includes gathering and valuing assets, paying off debts, handling taxes, and distributing property to your named beneficiaries. Choosing the right executor is important because they will be dealing with sensitive family matters and legal responsibilities. While a spouse or adult child is often selected, it’s also possible to name a trusted friend or a professional such as a financial advisor. In Florida, your executor—referred to legally as a “personal representative”—must meet certain qualifications, such as being over 18 and mentally competent.

Beneficiary Designation

Beneficiary designation refers to the act of naming specific individuals or organizations to receive certain assets after your death. These designations are typically used for life insurance policies, retirement accounts, and payable-on-death bank accounts. Unlike a will, beneficiary designations bypass probate and transfer assets directly to the chosen person. It’s essential to regularly review and update these designations, especially after significant life events like marriage, divorce, or the birth of a child. Incorrect or outdated beneficiary information can override the instructions in your will, so consistent review is a key part of maintaining an effective estate plan.

Revocable Living Trust

A revocable living trust is a legal document that places your assets into a trust during your lifetime and allows you to retain control of them while you are alive. After death, the assets are distributed to your beneficiaries without going through probate. The term “revocable” means you can change or cancel the trust at any time while you are mentally competent. Many Jacksonville residents choose to include a revocable living trust in their estate plan to avoid delays and minimize court involvement. This tool is particularly helpful for individuals with property in multiple states or those who wish to keep their estate matters private.

Health Care Surrogate

A health care surrogate is someone you legally appoint to make medical decisions for you if you become unable to do so yourself. In Florida, this designation must be made in writing and signed in the presence of witnesses. The person you choose should understand your healthcare preferences and be willing to advocate for them in stressful situations. A health care surrogate is not limited to end-of-life decisions; they can be involved in any medical situation where you are temporarily or permanently incapacitated. Including this document in your estate plan ensures your medical choices are honored when you cannot speak for yourself.

Pour-Over Will

A pour-over will is a type of will used in conjunction with a living trust. It directs that any assets you owned at the time of your death that were not already in the trust should be transferred—or “poured over”—into the trust upon your passing. This helps ensure all your assets are ultimately managed according to the terms of your trust. While the pour-over will still needs to go through probate for the assets not originally placed in the trust, it simplifies the overall administration of your estate. This tool provides a backup plan and acts as a safeguard, capturing any overlooked property not previously transferred into the trust.

Choosing the right legal documents and understanding their functions is essential to building a solid estate plan. At Sahyers Firm LLC, we work closely with each client to create personalized, legally sound plans that reflect their values and protect their legacy.

If you’re ready to build or update your estate plan, our Jacksonville estate planning lawyer is here to help. Call us today to schedule a consultation and take the first step toward protecting your future.

Secure Your Future With The Right Legal Plan

Estate planning is one of the most important steps you can take to protect your assets and make certain your family’s financial security. Without a proper plan, your estate could face legal complications that delay the inheritance process and increase costs for your loved ones. Whether you need to draft a will, establish a trust, or update your existing estate plan, having an experienced attorney by your side makes all the difference. Our Jacksonville estate lawyer at Sahyers Firm LLC is here to help you manage your estate planning process and provide guidance tailored to your unique needs. Contact us today to get started and gain peace of mind knowing your future is secure.